A tax preparation worksheet is a tool designed to help organize and streamline the process of compiling necessary information for filing income tax returns․ Available as downloadable PDFs, these worksheets guide users in gathering details about income, deductions, credits, and other relevant financial data, ensuring accuracy and compliance with tax regulations․ They are particularly useful for individuals and professionals aiming to simplify tax preparation and maximize refunds․ By using a tax preparation worksheet, taxpayers can efficiently collect and report their financial information, making the tax filing process smoother and less overwhelming․ These worksheets are often updated annually to reflect current tax laws and requirements, such as those for the 2023 tax year․

Overview of Tax Preparation Worksheets for 2023

The 2023 Tax Preparation Worksheet is a comprehensive tool designed to assist individuals and professionals in organizing financial data for accurate and efficient tax filing․ These worksheets, often available as downloadable PDFs, cover essential sections such as income, deductions, and credits, ensuring all necessary information is accounted for․ They are tailored to align with the 2023 tax year requirements, incorporating updated tax laws and regulations․ The worksheets are user-friendly, allowing taxpayers to input their financial details systematically, reducing the risk of errors․ Many 2023 worksheets also include interactive features, enabling users to save and edit their progress electronically․ Additionally, they often provide spaces for attaching supporting documents, such as W-2s and 1099s, making it easier to reference and verify information․ By using a 2023 Tax Preparation Worksheet, individuals can streamline their tax preparation process, ensuring compliance with IRS guidelines and maximizing their potential refunds․

Why Use a Tax Preparation Worksheet?

Using a tax preparation worksheet offers numerous benefits for individuals and professionals alike․ It simplifies the complex process of tax filing by organizing financial data into clear, manageable sections․ This tool helps ensure accuracy by reducing the likelihood of errors and omissions, which can lead to delays or audits․ A worksheet also saves time by providing a structured format for inputting income, deductions, and credits, making it easier to review and verify information․ Additionally, it serves as a useful reference for tracking expenses and ensuring compliance with tax laws․ For the 2023 tax year, worksheets are updated to reflect current regulations, including any new deductions or credits available․ By using a tax preparation worksheet, taxpayers can streamline their filing process, minimize stress, and maximize their potential refund․ It is an essential resource for anyone looking to navigate the tax preparation process efficiently and effectively․

Understanding the 2023 Tax Preparation Worksheet

A tax preparation worksheet is a tool designed to organize financial data for accurate tax reporting․ It streamlines the process by categorizing income, deductions, and credits, ensuring compliance with 2023 tax regulations․

Key Sections of the 2023 Tax Preparation Worksheet

The 2023 tax preparation worksheet is divided into several essential sections to ensure comprehensive tax reporting․ The first section focuses on income, where users input details such as wages, salaries, tips, and self-employment earnings․ Additionally, it includes spaces for interest, dividends, capital gains, and other miscellaneous income sources․ The deductions section allows taxpayers to list expenses like mortgage interest, property taxes, charitable contributions, and medical expenses, helping to reduce taxable income․ A separate area is dedicated to credits, such as the Earned Income Tax Credit (EITC), education credits, and child tax credits, which directly reduce the tax liability․ The worksheet also includes sections for personal information, such as Social Security numbers, dependents, and filing status․ Furthermore, it covers retirement account contributions and estimated tax payments made during the year․ Each section is designed to guide users through the tax preparation process systematically, ensuring no critical information is overlooked․ By organizing data into these categories, the worksheet simplifies the process of completing an accurate tax return․

Income, Deductions, and Credits: What to Include

When completing the 2023 tax preparation worksheet, it’s crucial to accurately include all relevant income, deductions, and credits․ Income sections require details such as W-2 wages, 1099 earnings, self-employment income, and retirement distributions․ Interest and dividends from bank accounts or investments should also be reported․ Deductions cover expenses like mortgage interest, property taxes, medical bills, and charitable donations, which reduce taxable income․ Credits, such as the Earned Income Tax Credit (EITC) or education credits, are also essential as they directly lower the tax owed․ Additionally, include information about dependents, childcare costs, and student loan interest․ Ensure all documents like W-2s, 1099s, and receipts for deductions are attached to support the claims․ Accurate reporting of these items ensures compliance with tax laws and maximizes potential refunds․ Proper organization of these details within the worksheet simplifies the tax filing process and helps avoid errors or missed opportunities for savings․ This systematic approach ensures all necessary information is included for a precise and efficient tax return․

How to Use the 2023 Tax Preparation Worksheet Effectively

Start by organizing all financial documents and entering income, deductions, and credits accurately․ Follow the step-by-step guide, and review each section thoroughly to ensure completeness and compliance․ This approach simplifies the tax filing process and ensures accuracy․

Gathering Necessary Documents

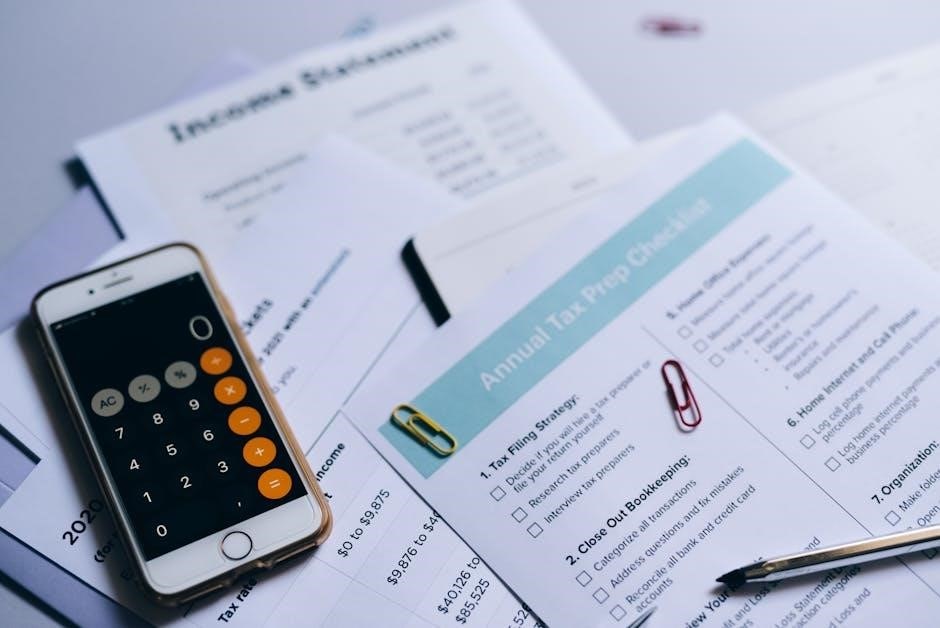

Gathering the necessary documents is the first step in effectively using the 2023 tax preparation worksheet․ Start by collecting all relevant income-related documents, such as W-2s, 1099s, and any other forms detailing earnings from employment or freelance work․ Next, compile records of deductions, including receipts for medical expenses, charitable contributions, and mortgage interest statements․ Credits-related documents, such as childcare expense receipts or education-related forms, should also be organized․ Additionally, gather proof of payments like estimated tax records or receipts for state and local taxes․ Organize these documents in a logical order, ensuring they align with the categories outlined in the worksheet․ Double-check that all forms are complete and legible, and include any additional sheets if space is limited․ By having all documents ready, you can efficiently transfer the information to the worksheet, reducing errors and saving time during the tax preparation process․ Proper organization ensures accuracy and compliance with tax requirements, making the overall process smoother and less stressful․

Step-by-Step Guide to Filling Out the Worksheet

Start by reviewing the 2023 tax preparation worksheet and familiarizing yourself with its sections․ Begin with the personal information section, ensuring all details like name, address, and Social Security number are accurate․ Next, move to the income section, where you’ll list all sources of income, such as wages, freelance earnings, and retirement distributions, using documents like W-2s and 1099s․ Deductions come next, so organize receipts for medical expenses, charitable contributions, and mortgage interest, ensuring they align with the worksheet’s categories․ Credits, such as those for childcare or education, should be documented with relevant forms․ After filling in all sections, review the worksheet for completeness and accuracy, checking for any missing information or errors․ If additional space is needed, attach separate sheets with clear labels․ Finally, sign and date the worksheet before submitting it along with supporting documents to your tax preparer or filing it with your return․ This systematic approach ensures a smooth and efficient tax preparation process․

Maximizing Your Tax Return with the Worksheet

Using a 2023 tax preparation worksheet helps organize income, deductions, and credits, ensuring accurate reporting and maximizing your refund․ It guides you to identify eligible deductions and credits, optimizing your tax strategy while adhering to current tax laws․

Common Deductions and Credits for 2023

In 2023, several deductions and credits remain popular for maximizing tax returns․ The Earned Income Tax Credit (EITC) continues to benefit low-to-moderate-income workers, while the Child Tax Credit provides relief for families with qualifying dependents․ Deductions for student loan interest, charitable contributions, and medical expenses are also widely utilized․ Additionally, the Savers Credit rewards eligible individuals who contribute to retirement accounts․ Homeoffice deductions remain relevant for self-employed individuals and remote workers, while mortgage interest and property tax deductions benefit homeowners․ Credits like the American Opportunity Tax Credit and the Lifetime Learning Credit support education expenses․ Itemized deductions, such as state and local taxes (SALT), are capped but still valuable for high-tax states․ Consulting a tax professional or using a worksheet ensures you claim all eligible deductions and credits, optimizing your return and minimizing tax liability․ Accurate documentation and adherence to IRS guidelines are essential for compliance․ Staying informed about annual changes ensures you don’t miss out on beneficial opportunities for tax savings․

Best Practices for Accuracy and Compliance

To ensure accuracy and compliance when using a 2023 tax preparation worksheet, it’s essential to follow best practices․ Start by gathering all necessary documents, such as W-2s, 1099s, receipts, and prior-year returns, before filling out the worksheet․ Double-check each entry for completeness and correctness, as errors can lead to delays or audits․ Use the worksheet’s structured sections to organize income, deductions, and credits systematically․ Take advantage of fillable PDF features to reduce handwriting errors and ensure legibility․ When uncertain about specific deductions or credits, consult IRS guidelines or seek professional advice․ Regularly save your progress to avoid data loss, and review the worksheet thoroughly before submitting it to your tax preparer or filing it yourself․ Additionally, verify that all calculations align with current tax laws and updates for the 2023 tax year․ By adhering to these practices, you can enhance the accuracy of your tax return and maintain compliance with regulatory requirements, minimizing the risk of issues with the IRS․